By Eirini Louizou, Head of Production & Industrial Printing at Infosource

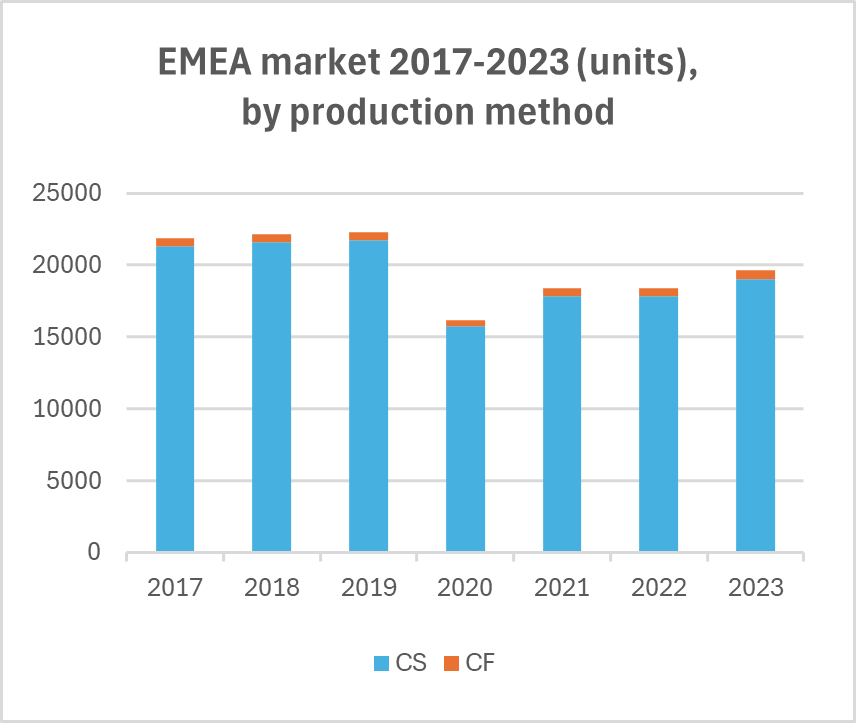

Production printers are high-speed printers, starting at a speed of 60 pages per minute (ppm), used for high-volume print applications at low cost and superior quality. A common categorization is based on the production printing method, with production printers distinguished as Production Cut-sheet (CS) and Continuous-feed (CF).

Both the CS and the CF markets are expected to grow in the coming years, with emphasis on Color Press CF devices. These printers can be used for: commercial, transactional, publishing, label, and packaging applications. Digital production printing manufacturers are continuously improving their products and driving market growth by:

enhancing inkjet printing technologies

developing advanced printheads

improving ink formulations and

improving workflow solutions

Digital devices are displacing offset devices, due to increased demand for shorter runs and faster delivery times. At the same time, digital devices offer limitless opportunities due to their color consistency, media handling options, high printing speed, personalization capabilities, and output quality.

Production print has evolved rapidly during the last few years, both from a technological perspective that can be considered as an internal factor to the industry, and the behavioral changes in society (e.g. increased demand in e-commerce, audio books, etc.) that can be described as an external factor to the production industry.

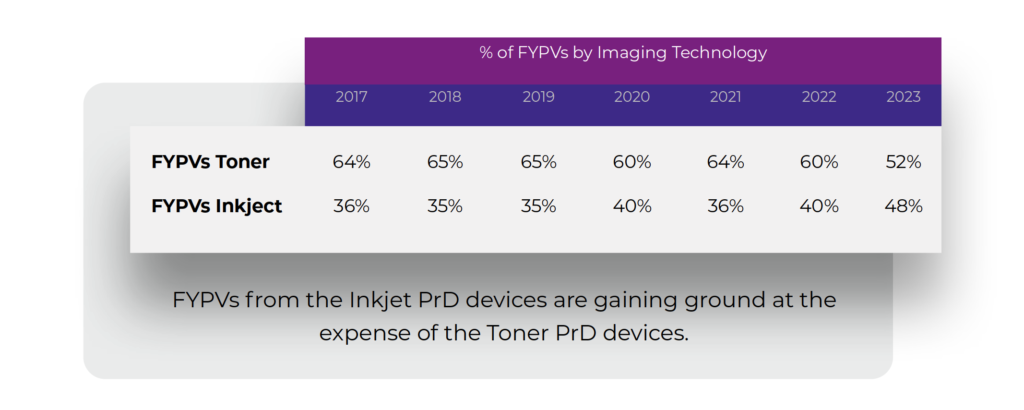

Both these factors are reflected to measurable trends and shifts within the production market, e.g. the shift to color production devices, the increased demand for CF devices, the shift to inkjet devices vs toner, and shifts between different applications (commercial, label, packaging, etc.).

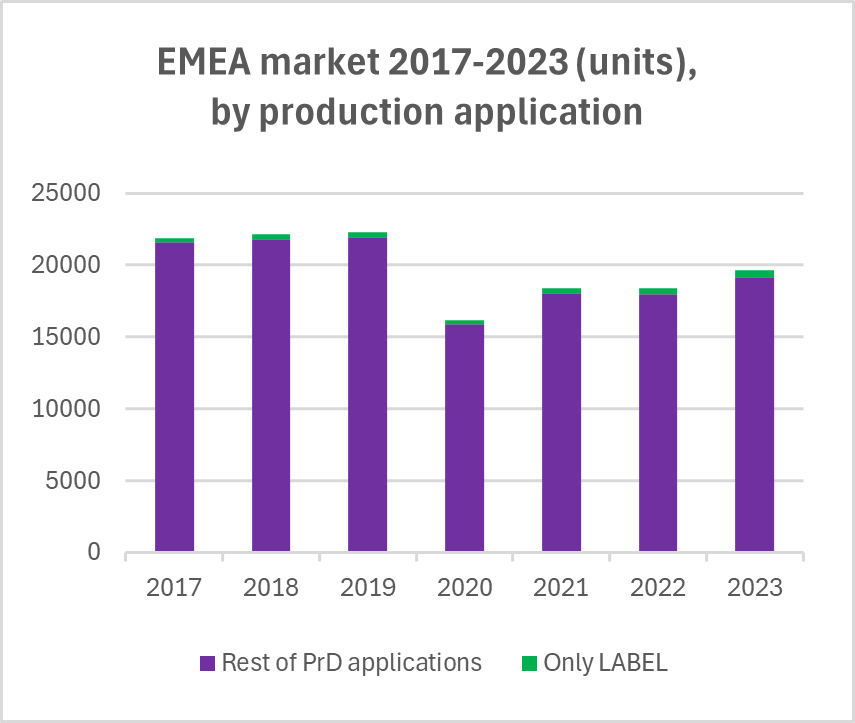

In Europe, Middle East and Africa (EMEA) for the 2017-2023 period, CF production devices increased by 8% in unit sales in 2023 compared to 2022 and accounted for 3.1% of total unit sales across this region. However, by considering the year 2017, CF devices accounted only for 2.6% of total EMEA unit sales. Considering the applications shown in the diagram to the right, the Label application accounted for 2.3% of total unit sales in EMEA in 2023, while in 2017 it accounted for 1.2% of total unit sales in the region.

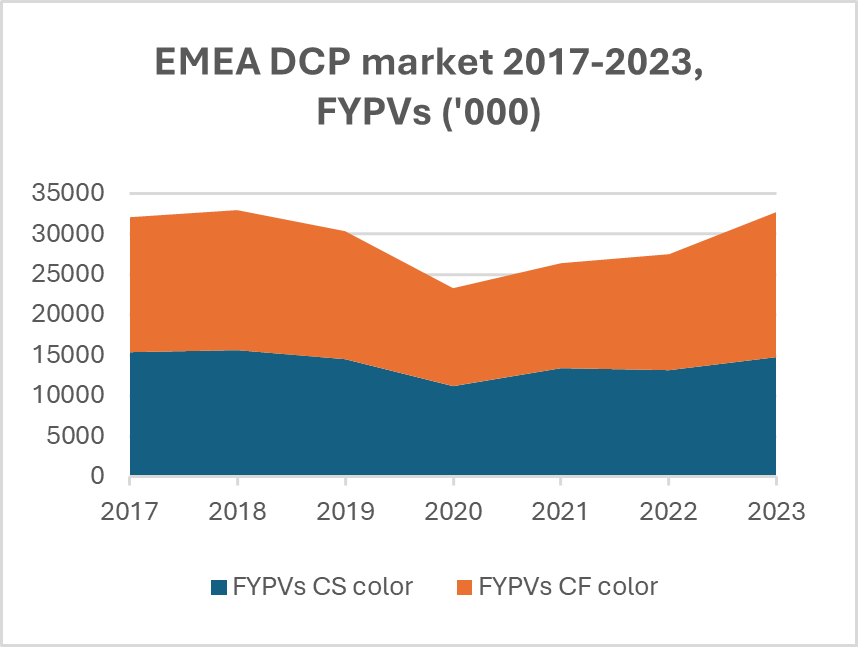

Despite the small number of the CF devices compared to the CS devices in unit sales, if we consider CF’s revenue or full year print volumes (FYPVs), then the picture changes significantly. For instance, by considering the Digital Color Press (DCP) production market in FYPVs, between the CS and CF devices, we see that:

the CF Color FYPVs accounted for 52% of total DCP FYPVs in 2017 in EMEA, while in 2023 accounted for 55%. This percentage is expected to increase further in the coming years, with a compound annual growth rate (CAGR) for Color CF devices projected at 8.61% by the end of 2027 for the EMEA region. Similar trends are projected for the global market, where CAGR is projected at 5.52% by the end of 2027 for the Color CF devices in unit sales.

The Americas form the largest market

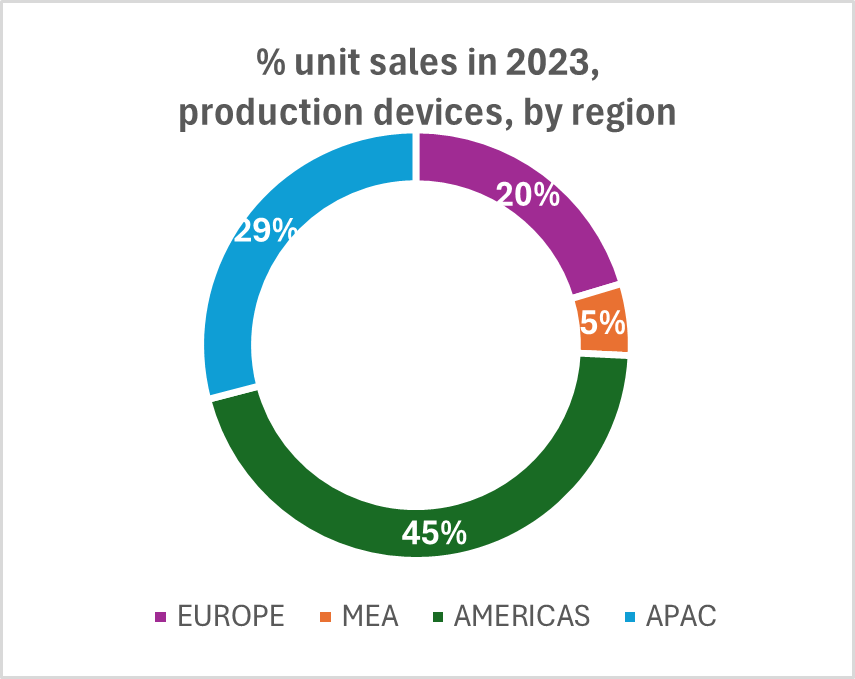

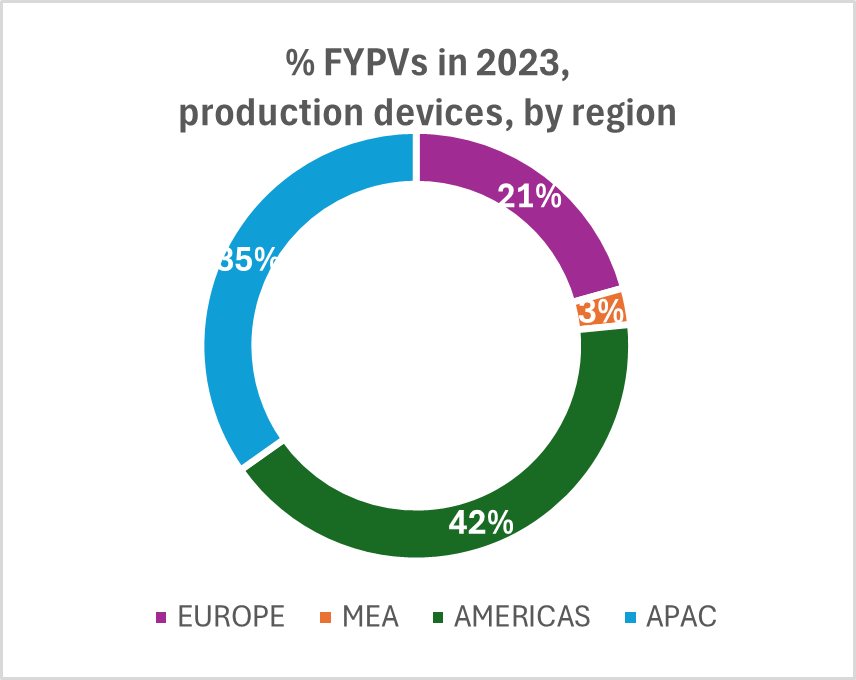

Taking into account the sub-categories* in which every region is strong (as a consequence of their maturity and saturation of the production industry) and the economic robustness, we may draw some conclusions. In the year 2023, in terms of unit sales, Americas (North America and LATAM countries) accounted for 45% of global unit sales, while in FYPVs accounted for 42%. The second largest region that grows with the biggest CAGR is APAC, which in 2023 accounted for 29% in unit sales but for 35% in FYPVs out of the global market. For APAC region, this is well explained if we consider the number of brands being active, the sub-categories* that are most populated in the region in unit sales, as well as the entrance of Asian low-cost brands producing high print volumes. Considering the number of brands being active in the above-mentioned regions for 2023: there were 52 active brands in APAC, while in North America there were only 35 active brands.

* sub-categories: 1: CopPrt BW, CS, 2: Printer BW, CFd, 3: CopPrt Color, CS, 4: CPress, CS, 5: CPress, CFd

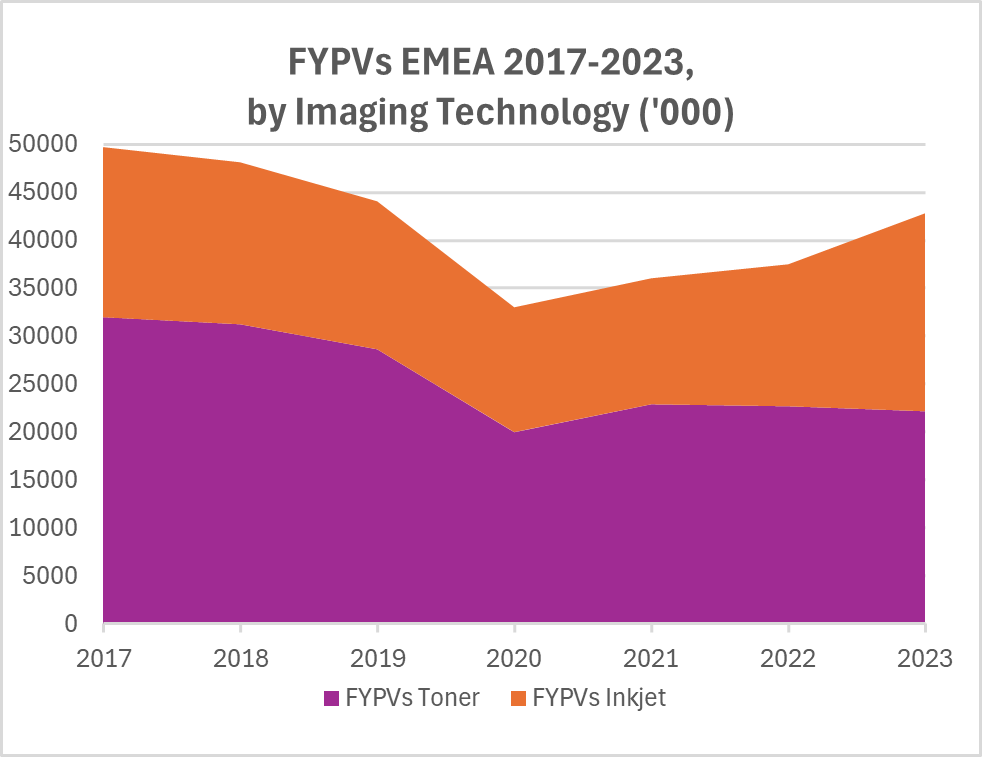

As for the FYPVs by Imaging Technology (Inkjet, Laser), we clearly see that the FYPVs of the Inkjet devices has constantly increased in EMEA, with an increase of 58% in 2023 versus 2020.

Overall, more than 1 billion pages are expected to be printed from Inkjet devices instead of Toner devices by the end of 2027.

Positive future trends ahead

The global production market is not only returning to normal after lockdown-related slowdowns, disruptions in supply chain, and the energy crisis related issues, but it is also in an upward trend. Indeed, a positive CAGR is projected for the total production market in unit sales that will entail to higher FYPVs. Some applications are declining or remaining flat (e.g. book printing), while others are dynamic with projected promising print volumes (e.g. label, packaging).

Last but not least, the digital production market is expected to continue gaining market share from the offset market, as already mentioned, since the quality of the digital devices, together with their ability to offer short runs at low costs, are continuously improving. Overall, the digital production market is expected to thrive in the years to come, and its analysis will be of high interest and value.