By Petr Kramerius, Regional Manager at Infosource

Single-function page toner/laser printer sales continued their long-term decline within Europe in the first half of 2024, but will remain a meaningful share of revenues and unit sales for the foreseeable future. They still offer a low cost to print with enhanced sharpness, high quality, accuracy and rapid speeds.

Nonetheless, the devices are facing intensified competition from multifunction toner/laser devices. This trend will reshape the market in the years to come. Let’s dive into our single-function page toner/laser printer data for the first half of 2024 for Western and Eastern Europe.

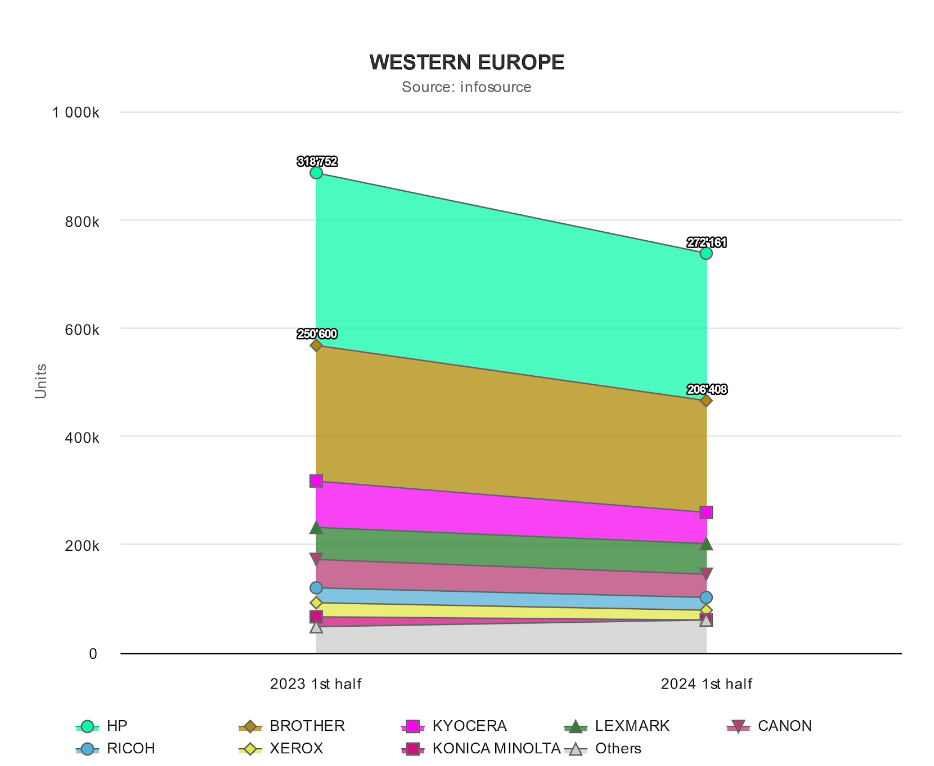

17% drop for SFP sales in Western Europe

Unit sales in Western Europe’s single-function toner (laser) printer (SFP) market declined by 17% in the first half of 2024 compared to H1 2023 in the face of continued customer preference for multifunction laser and inkjet devices. Despite the decline in sales, SFPs represented around half of the overall toner/laser MFP market in Western Europe.

The Western European toner/laser SFP market was worth around €326 million, down 13% for the period. The total toner/laser MFP market in the region generated sales of around €4.3 billion for the first half and the total inkjet market (SFP and MFP combined) was worth €754m.

Unit sales decreased in all markets in the region, besides Greece and Portugal. Germany, the largest market accounting for 26.1% market share, decreased by 15% and Italy, the second-largest market (13.5% share), shrank by 19%. The UK market (11.1%) declined by 31%. Spain overtook France in fourth place, despite an 8% drop in sales.

Sales decline across BW and color segments

Monochrome (BW) SFP represented 82% of the market in H1 2024. BW printer unit sales decreased by 14%, while color SFP declined by 26%. All speed categories in color SFP saw sales drop, including a 12% decline in 30-49 page-per-minute (ppm). The sharpest drop within the BW speed categories was recorded within the low-end (0-19 ppm, 20-29 ppm and 30-39 ppm), while the 40-59 ppm category declined by 8%. The high-end market (60-90+ ppm) fell by 25%.

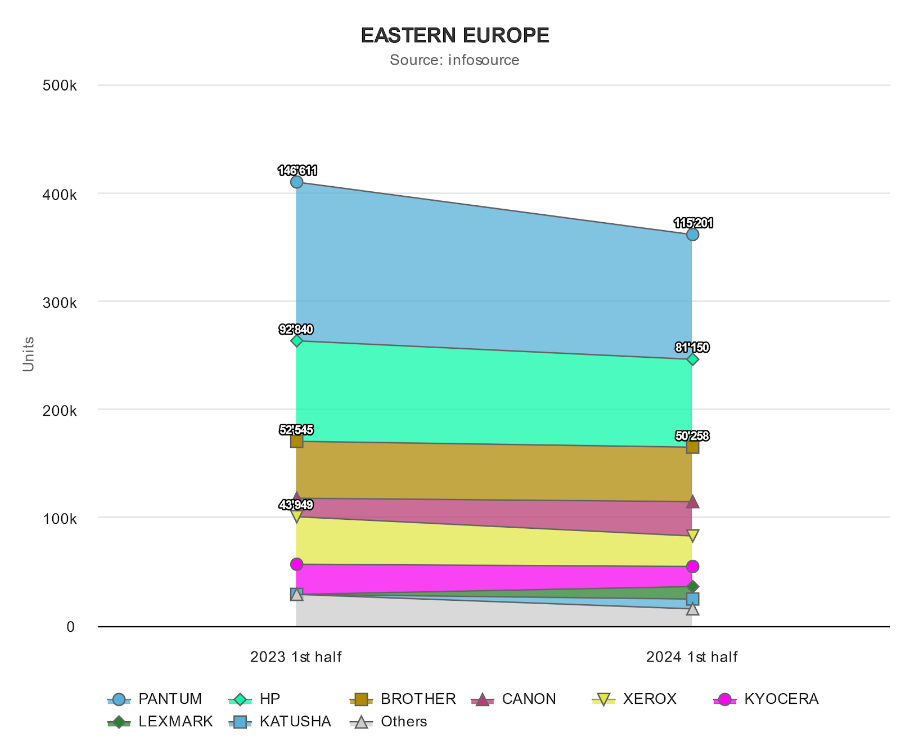

12% decline for SFP market in Eastern Europe

Unit sales in the Eastern European toner/laser SFP market decreased by 12% year-over-year in H1 2024. The Eastern European SFP market represented 49% of the total overall toner/laser MFP Eastern European market. Market value, at €95 million, fell 3% during the period under review.

Many countries saw significant declines, including Russia (35% of unit sales), which declined by 21%. Poland, the second-largest toner/laser MFP market (19.9% share), saw a 6% uplift in sales for H1 2024. Kazakhstan, the fourth largest market, expanded by 2%. Azerbaijan, Albania, Croatia and Slovenia all grew, while sales dropped in the Czech Republic (third largest with 9.2% share) and Romania (fifth-largest with 4.8% share). The Ukraine market shrank 20%.

Color sales go up, BW sales drop

The BW market took a 90% share of the total toner/laser SFP market with a 13% decrease in unit sales in H1 2024. The 20-29 ppm category, which declined 23%, accounted for just over half of unit sales. The 40-59 ppm category (29.9% share) registered a 1% increase and 30-39 ppm was up 7%, marking a shift towards higher speeds.

Color toner/laser SFP unit sales registered an increase of 4% compared to H1 2023. By contrast with the trend to higher speeds in the BW market, the low-speed 10-19 ppm category grew 20% to move up from the fourth-largest category. The main category of 20-29 ppm registered a rise of 18%.

Brands in flux in Eastern Europe

Brand positions in Eastern Europe continue to be shaken up by sanctions in Russia, with the vacuum left by traditional brands filled by new competitors, many of them Chinese. Pantum, which has a large and growing footprint in Russia, took the number one spot in Eastern Europe with 31.9% market share.

HP retained second position with a 22.5% market share despite a 13% decline in sales, followed by Brother, which registered 13.9% share and a unit sales drop of 4%. Canon overtook Xerox and Kyocera to finish in fourth place. Many Western brands remain available in Russia via parallel imports, but it is difficult to track these sales accurately.

Color toner/laser SFP unit sales registered an increase of 4% compared to H1 2023. By contrast with the trend to higher speeds in the BW market, the low-speed 10-19 ppm category grew 20% to move up from the fourth-largest category. The main category of 20-29 ppm registered a rise of 18%.