April 2025

By Ralph Gammon, Senior Analyst, Infosource Capture & IDP SW

On April 2, which was promoted by U.S. President Donald Trump as Liberation Day, the administration announced that it will be imposing a minimum 10% tariff on all imported goods, with higher “reciprocal” tariffs for countries where the U.S. sees higher taxes imposed on its exports. Japan, for instance, which is where most of the leading MFP and scanner manufacturers have their headquarters, is being hit with a 24% tariff.

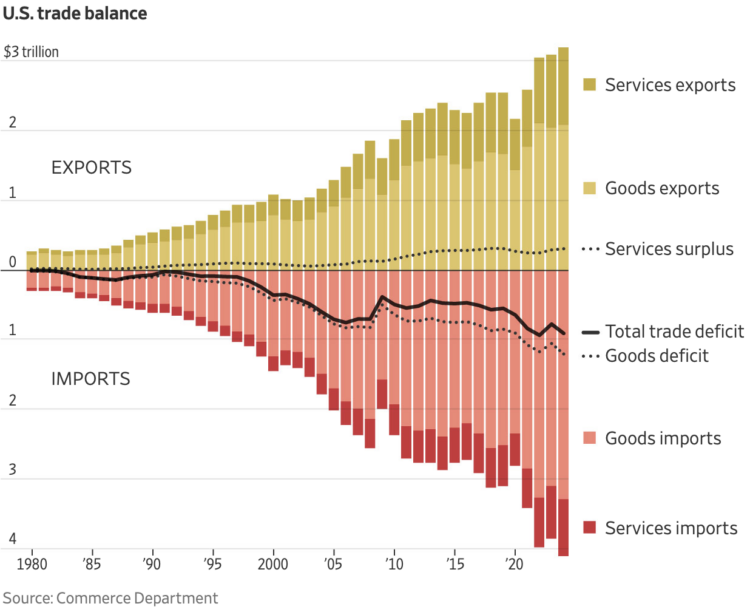

The tariffs are designed to reverse a growing U.S. trade deficit:

President Trump has touted that with help from the new tariffs, “Jobs and factories will come roaring back into our country…” Many economists are more skeptical, citing inflation and recession as potential near-term results. Some see tariffs as a regressive tax that mostly affect consumers in the importing country.

IMPACT ON CAPTURE AND PRINT HARDWARE MARKET

It seems the tariffs will directly affect the scanner and printer markets. In fact, in November, Ricoh announced that it would be moving some of its MFP manufacturing from China to Thailand in preparation for potential tariffs imposed by the then incoming Trump administration. With the latest tariff announcements, shipments from China are facing a 34% tariff, which is additive to a previously announced 20% tariff. Thailand, however, is now also facing a 36% tariff rate.

In 2019, when threats of tariffs under the previous Trump administration started to circulate, Ricoh estimated that it could lose tens of millions of dollars if it did not move its manufacturing out of China.

Of the leading scanner vendors, PFU (which is owned by Ricoh), Canon, Epson, and Brother are all based in Japan, but manufacturing can be spread throughout Asia. For several years, Kodak Alaris has utilized China as its main manufacturing center. HP primarily manufactures scanners in Asia as well. Some of these vendors do have assembly stations in the Americas to help avoid some local tariffs and meet federal government purchasing regulations, including in the U.S. These facilities could now be expanded although it seems the components will still be taxed if they are manufactured elsewhere.

We also may see more manufacturing moving to countries like Vietnam, which has indicated that it wants to work with the U.S. to reduce its tariff rates. Indications are that the U.S. government is open to negotiations on the tariffs, which is in line with the strategic aim of reducing the country’s trade deficit. We expect to see plenty of movement over the next few weeks related to the tariffs.

ibml is the only leading scanner manufacturer with its primary manufacturing based in the U.S., at its headquarters in Birmingham, AL, but, like many U.S.-based manufacturers, ibml imports parts from other countries. ibml’s focus is on the higher volume production end of the market.

My analysis is that the tariffs will likely initially cause prices for scanners and MFPs to rise and make users more hesitant to upgrade to newer models. If they are installing new units as part of a project, they may just opt for a less expensive model, or the overall ROI of the project will be significant enough to absorb the hardware price premium created by the tariff. The trend with scanners has been toward delivering increased functionality at a lower price, and we expect this to continue and to soften the blow over time.

Impact on SW market

The U.S. tariffs’ potential effect on the Capture & IDP SW market is less clear. For one, most of the leading vendors are currently headquartered in the U.S. Second, historically software has not been subject to tariffs.

The fact that many U.S.-based ISVs employ or contract development teams in countries with lower-cost resources should also be considered. Reports I have seen so far indicate that tracking outsourced services would be too difficult for the U.S. government and therefore they would not be subject to tariffs.

There is some potential impact on cloud hosting costs if the tariffs increase the price of computer hardware, but, for now at least, there is an exception in place for imported semiconductors, almost half of which come into the U.S. from Taiwan.

If historical trends hold up, a potential recession might have only a short-term negative effect on Capture and IDP SW sales. While market growth slowed significantly in both 2008 and 2020, as a result of the global financial crisis and the pandemic respectively, the market rebounded strongly in both 2009 and 2021. It seems that facing an economic downturn, after initially exercising caution in their spending habits across the board, businesses eventually realize they need to invest in improving efficiencies, which is one of the primary benefits of Capture & IDP.

Impact on Integrated HW & SW solutions

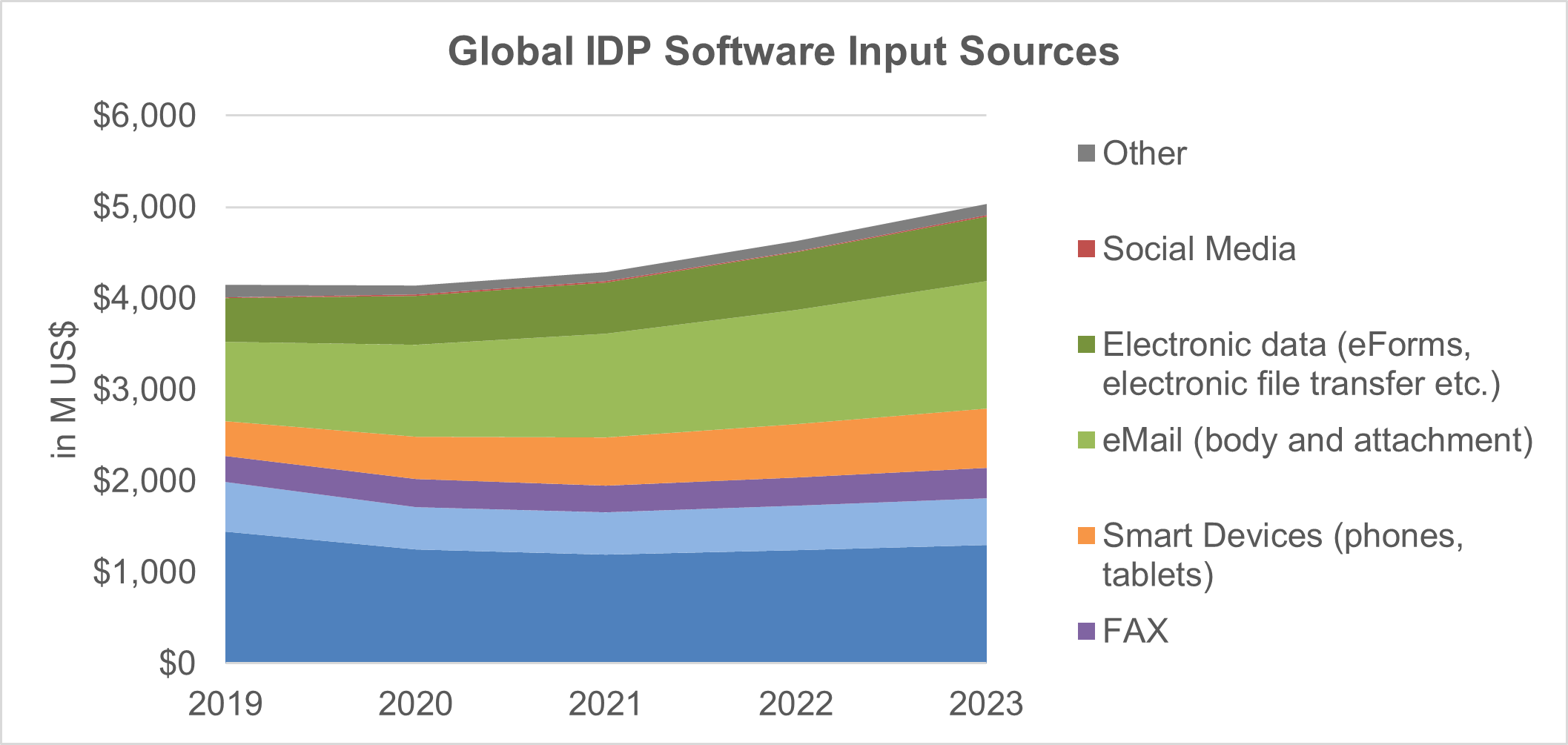

For the past several years, ISVs have been reporting that less and less of their revenue is related to processing pages coming directly off scanners and MFPs. This means that ROI is now primarily being driven by other types of inputs, which should help minimize any effect that increased hardware prices would have on the Capture & IDP SW sales.

Expect some Give and Take

The 10% global tariffs are slated to go into effect April 5, with the reciprocal tariffs scheduled for April 9. This is not a lot of time for some of the affected countries to attempt to renegotiate but, based on what we saw with earlier tariffs targeted at Canada and Mexico, I expect at least some movement in the rates. That said, In the “reciprocal” tariff rates are actually based on a formula the uses trade deficits with each country, which means that actually negotiating proper reciprocal trading rates will not be as straightforward as it sounds.

This is not the first upheaval the current U.S. administration has caused in the market. The recent shake-up and downsizing related to the federal government has already had an adverse effect on projected SW sales. The US market is certainly in flux and we will keep you updated on current developments.